Trust in the force of time.

Trust in the force of time.

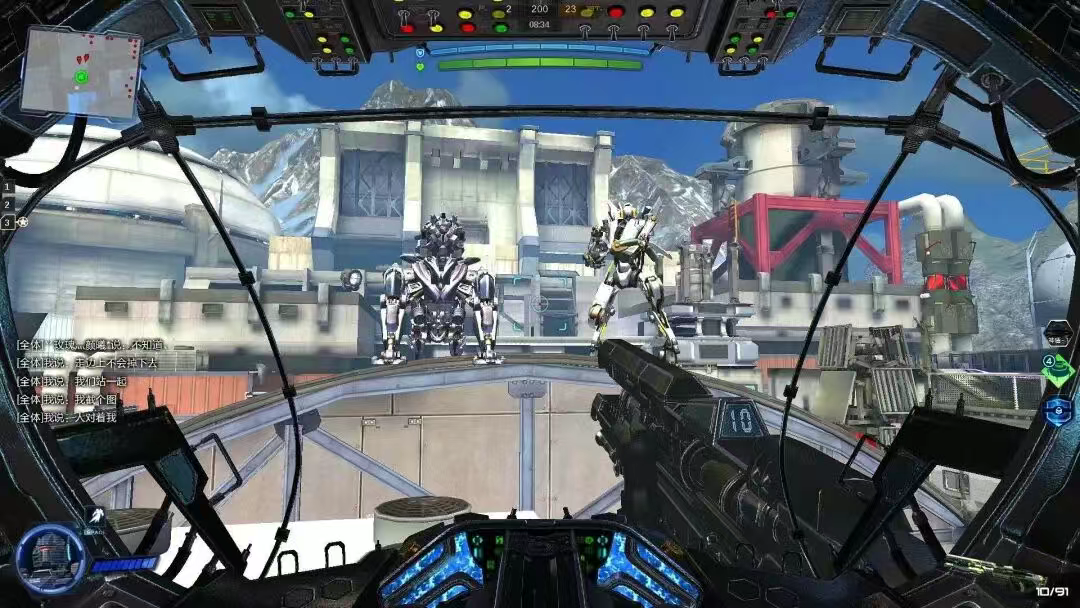

From an external perspective, over the past 4-5 years, the outside world's evaluation of Tencent Games' performance has almost undergone a complete reversal from "pessimism" to "firm optimism". Talking about this change, Ma joked, "A few years ago, people were saying things like 'Is Tencent losing its edge?' or 'Has Tencent made a lot of mistakes?'... But it's like playing a fighting game with very high latency—once you press the button to throw a punch, you can't take it back; all you can do is wait. Quite magically, by 2024, everything suddenly turned for the better, yet we actually didn't change a thing." Ultimately, gaming is a content industry with its own objective development and growth cycles. In fact, whether it's the strongly trending Delta Force, the milestone domestic single-player title Black Myth: Wukong, or the well-received Phantom Blade Zero at this year's Gamescom, the project approval or investment for these products happened around 2021. Phantom Blade Zero "My understanding of the gaming industry cycle is getting longer. I used to think it was about 2-3 years, but recently I often say internally that a cycle in this industry might be 4-5 years," Ma said. Now, the gaming industry stands at the start of another 5-year period. The judgments made and decisions taken today will only truly be verified and yield results around 2030, and this holds true for Tencent as well. The Gaming Industry Has a Very Low Success Rate This year, when discussing competition in the gaming industry with some practitioners, many unanimously exclaimed: "Tencent is a bit too strong." Indeed, from being questioned to being recognized, in four or five years, Tencent has quietly gained significant advantages in multiple genres globally, especially in shooters. Some even wonder: if Tencent manages to increase the number of its evergreen games to 20 or even 25, how much room will be left for other developers to compete with Tencent? However, in Ma 's view, the potential of the gaming market is likely far greater than what we currently see. On one hand, there are approximately 3.5 billion gamers worldwide. These players can be divided into numerous niche segments based on different criteria such as gameplay preferences, cultural backgrounds, and personal tastes. The key lies in whether developers can create genre-defining products for these niche markets—each segment holds opportunities and room for growth. He supplemented with an example: "Currently, shooter games account for about 20% of the Chinese market share. From our research, globally, shooters make up roughly 35% of the overall market. When comparing these two figures, it's clear that China's shooter game market still has the potential to double in size." From a certain perspective, genre gaps indeed exist. For instance, to this day, we haven't seen a genuine domestically developed PVE shooter gain traction in the Chinese market. Yet, user demand for such games is undoubtedly present; the challenge lies more in finding the right solution. At the same time, Ma repeatedly emphasized that the gaming industry has an extremely low success rate, with competition fiercer than one can imagine. The hit products we see today have actually "broken through" from a pile of failed products. Helldivers 2 "For example, in the past full year, there were about 19,000 PC games on Steam, and over 60,000 mobile games. How many were successful? Probably only 6 new games crossed the 'evergreen game revenue line': Zenless Zone Zero, Wuthering Waves, Love and Deepspace, Helldivers 2, Black Myth: Wukong, and Delta Force. These six teams have all been working in their respective fields for a long time," Ma said. Beyond keeping an eye on new releases, Ma also tracks the development of evergreen games worldwide. Currently, there are around 70 products globally that meet Tencent's criteria for evergreen status. Each year, roughly 5-6 games are removed from this list, meaning the number of evergreen games doesn't necessarily keep growing. In Ma's opinion, being evergreen is an outcome. "Ultimately, games that can define a genre and are committed to continuously developing and operating to meet players' needs have the potential to become evergreen. People always look for a sufficient condition—something that, if achieved, guarantees success. But more often than not, you first need to meet 10 necessary conditions (a rough estimate) just to get a 'lottery ticket' for success. And even with that ticket, the highest probability of success is only 20%-30%." In summary, the global market today is still large enough, and Tencent doesn't seize every opportunity either. This leads to a problem that Tencent has been trying to solve: how to cover more niche markets and gradually increase the success rate of its products, making the highly risky endeavor of game development more "stable". The 3 'Rights' for Improving Success Rate Ma Xiaoyi identified three key factors: Right Vision, Right People, and Right Approach. Overall, these three R's are all about people, or rather, "decisions related to people." Right Vision means the team has a clear direction for the future, knows what kind of product they want to make, and that such a product has the potential to define a genre. Valorant: Operation Primal For example, Riot Games' Valorant. Although they hadn't made a shooter before, the development team felt there was room for optimization in similar hardcore shooters: sense of rhythm not strong enough, not modern enough, relatively simplistic gameplay, strong sense of frustration from round loss. They believed they could do better, even if it wasn't easy and required a long time, even multiple generations. POE 2 Another example is Path of Exile 2 developer Grinding Gear Games. They have been making loot-based games for nearly 20 years, always believing this direction holds great potential. This persistence also impressed Tencent. Rather than following market trends, Ma is more inclined to partner with teams that have dedication, passion, and conviction. In a sense, Right Vision and Right People are interconnected. Talking to many friends involved in game investments, they often say investment is essentially betting on people, as almost no one can accurately predict the industry's future development path. Therefore, the vision, capability, willpower, and cohesion of the core team become more tangible criteria for judgment. Speaking of this, Ma once again used Riot as an example. When Tencent first contacted Riot, the founding team members didn't have extensive experience in game company development. However, they had clear ideas and thoughts of their own and were willing to make commitments. "Correspondingly, we could also make commitments to the team—that was a very positive dynamic," Ma said. Having Right Vision and Right People is still not enough. In recent years, we have seen many top-tier studios with elite development talents suffer repeated "failures"; we have also witnessed star developers, once in the spotlight, start their own independent studios only to end up winding down their projects prematurely. Regarding this, Ma believes that good methods and good tools are also crucial—they can better help teams achieve the goals they want to accomplish. This is the Right Approach. Ma revealed that around 2022-2023, there was a deep internal technical discussion at Tencent. It was widely agreed that Unreal Engine 5 was significantly more advanced, and the suggestion was made for all teams to switch to UE5. However, the final decision was left to the teams themselves. Dune: Awakening "For example, Dune: Awakening also changed engines. Switching is painful, but we told the team: if the engine switch leads to delays, we are willing to increase the budget. The project was eventually delayed by a year, and our budget was extended accordingly. Even if it might ultimately cause the project to lose money, we accept it because we believe it's the right Approach. We have many similar decisions and support instances." In fact, I still vaguely remember that when UE5 was officially released, it really shocked many industry insiders. At that time, however, many companies and developers believed that due to limitations in device performance and product development cycles, large-scale adoption of UE5 would take a few more years, and UE4 would remain the mainstream for the next 3-5 years. But looking back now, the pace of change has been much faster than most people anticipated. Right Vision, Right People, and Right Approach are the necessary conditions for a product's success, and they largely determine the underlying framework of a product. Getting these three aspects right in the early stages of a project will naturally increase the odds of the product's success. Accumulation Is Always the Most Important In the latter part of the interview, we remarked that Tencent seems to be becoming more patient. "I think there's a misunderstanding here; actually, we've always been quite patient," Ma said. Tencent hopes to raise the success rate of more teams to 30%, giving them chance after chance to strive for evergreen status. "If the winning odds are only 30% each time, you might need to draw the lottery 4 times to win once. So I tell many teams, it's not that we are unwilling to spend money, but if you live long enough and can iterate many times, your probability of success will be greater; you can't say you're 100% sure of success this time and then go all-in." Last year, Ma mentioned in a media interview that teams capable of making successful games in the industry have often been dedicated to their field for an average of over 10 years. He has also emphasized the importance of "accumulation" in the gaming industry on multiple occasions. CrossFire Chinese version was officially launched in 2008 He also took the shooter genre as an example: "Today, people see that we have a strong presence in shooters, but what they don't know is that after the launch of CrossFire in 2008, we laid out plans for multiple shooter games in 2009. At that time, how many teams in China dared to invest so heavily in shooter games?" Assault Fire Among the multiple shooter projects, only Assault Fire ultimately succeeded, but the failed projects all became valuable experience for Tencent Games later when making shooter products. Patience alone is not enough either. Making products isn't about waiting passively for success or being rigid; it requires adapting to changes in the market and users. Ma feels one advantage Tencent has is that it frequently reviews its own practices and can objectively discuss what was done right and what was done wrong. For example, Tencent's view on GaaS (Games as a Service) has changed. "In the past, we would tell our Western studios: 'You should adopt GaaS.' This was correct because most evergreen games have adopted GaaS. But this is an End Game. To use a gaming analogy, you have to progress through each chapter step by step." So now, Ma says he doesn't oppose internal teams developing premium games at all—he even encourages them to do so. For a leading company like Tencent, cost is an unavoidable issue when it comes to developing premium games. The reason why most of the standalone games we see today come from small and medium-sized teams is essentially because the commercial revenue from premium games often cannot cover the labor costs of large companies. So why does Tencent still encourage internal teams to develop premium games? Ma admitted frankly: "Developing standalone games doesn't necessarily mean losing money. Moreover, we are willing to let teams break down the development process, spend multiple iterations refining the story and gameplay, and eventually achieve evergreen status." In fact, every step of this breakdown process is not easy. "In the past, we might have set a three-year plan, but now we say it's okay—you can take multiple iterations, as long as your ultimate goal is to create a good game, we are willing to accept a longer timeline," Ma said. This patience—or what I prefer to call "strategic determination"—is one of the key traits that will enable Tencent Games to compete in the next era. It is foreseeable that by around 2030, or even earlier, we will see more premium standalone products coming out of Tencent's ecosystem. These products also have great potential to become new calling cards for Chinese games. We often say that "a large ship is hard to turn around," but at many critical turning points, Tencent's speed and resolve in transformation have exceeded external expectations. We also sometimes say that large companies lack patience, but looking back now, Tencent may well be the most patient one of all.

本文系作者Shelby Zhu授权竞核发表,并经竞核编辑,转载请注明出处、作者和本文链接。想和千万竞核用户分享你的新奇观点和发现,点击这里投稿。