Seizing New Opportunities

Seizing New Opportunities

Sam has been a "veteran" in the game industry for 25 years. He has been closely following the development of the Chinese game market since ten years ago and has brought his team to participate in various game activities in China. In his memory, in the past, fewer countries came to China for exchanges at the same time; often only one or two countries were present simultaneously. But now, he is very happy to see so many different countries and companies gathering together: "CIGDC has done a great job in bringing people together."

Ukie, the organization he works for, is a support institution dedicated to providing a comprehensive business network for game developers or studios that want to develop in the UK. Ukie not only provides members with information such as international trade business, professional knowledge, and industry data, but also offers intellectual property support and office space. Sam hopes to help various developers thrive through these services, making the game industry a mature and responsible industry. Of course, he also warmly welcomes more Chinese game companies to enter the UK and even the entire European market through Ukie.

Currently, the UK is home to the largest game industry in Europe, with well-known game companies such as Microsoft, Activision Blizzard, and Sony having research and development bases in the UK. According to Ukie's statistics, the size of the UK game consumer market reached £7.82 billion in 2023. Between 2017 and 2022, non-British companies from 13 countries invested £6.87 billion in this field, including industry giants such as Warner Bros., Tencent, and NetEase.

Among them, in 2017, Tencent invested £17.7 million in Frontier Developments, the developer of Planet Coaster; in 2021, it acquired Sumo Group for £919 million (which has now undergone strategic adjustments); in 2023, it invested in Lighthouse Games, which is developing a "revolutionary" driving game... And these are just part of Tencent's investments in UK game studios. It can be seen that the Chinese and British markets have already begun to quietly integrate many years ago.

In Sam's view, the UK is an ideal place to make games, not only because there are excellent talents and a strong R&D atmosphere, but also because the British government has supported the game industry in recent years. For example, the UK has an electronic games tax relief policy, and game developers can apply to the British government for reimbursement of 20% of related production costs.

In addition, this year the British government launched a £30 million Game Growth Programme, aiming to promote the country's game industry on the global stage. This program will provide £10 million annually over the next three years to support game start-up studios and help them bring their games to the market. Sam believes that these policies are necessary forces to boost games into the market, and many game developers will benefit from them.

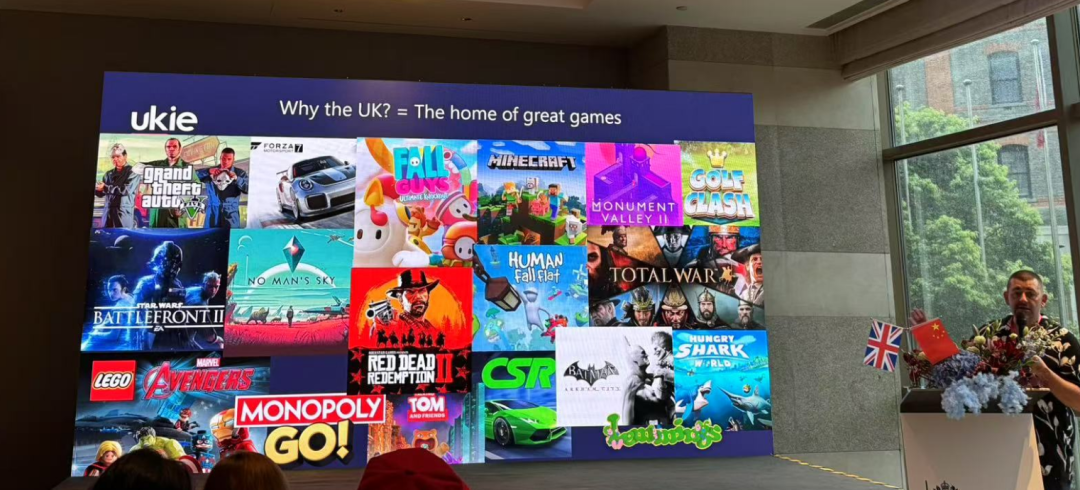

The UK game market has accumulated rich experience in developing large-scale games. Rockstar North (now independent as Build A Rocket Boy) located in Edinburgh, UK, developed the famous Grand Theft Auto series from the third to the fifth installment, showing excellent strength in open-world design, and even some players say that Rockstar North laid the foundation of the "GTA dynasty"; Playground Games in Leamington is famous for developing the Forza Horizon series; Lego Star Wars: The Skywalker Saga, which was nominated for more than ten awards including the British Academy of Film and Television Arts, was also co-developed by Sony's Guerrilla Games and Studio Gobo (UK).

However, the UK player market is different from China's. Players there are most exposed to games on consoles and PCs from an early age, while Chinese players are more accustomed to accessing games on mobile devices. Sam feels that their players are not as enthusiastic about mobile devices as Chinese players, which may be one of the reasons for the different game consumption habits between the two countries.

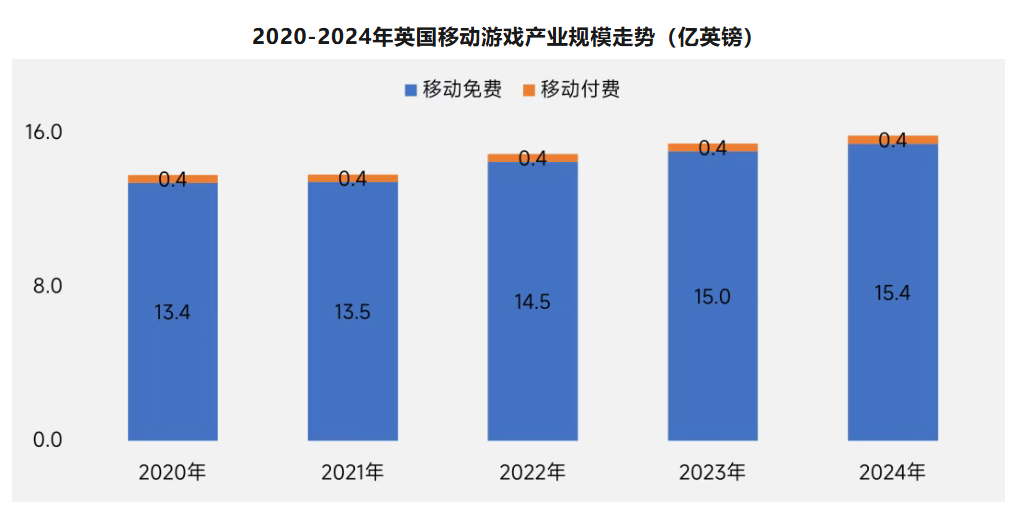

However, Sam pointed out that the previous view in the UK market that "it is difficult to achieve high-quality games on mobile devices" is changing. The UK mobile game industry has been steadily rising in recent years, and the mobile game market has certain growth potential.

According to Gamma Data statistics, China is the largest source of supply for the UK mobile game market, accounting for nearly 30% of the market share. At the same time, although most UK local developers focus on casual games such as puzzle mobile games, they are also gradually making efforts in the mobile game field.

Trend of UK Mobile Game Industry Scale from 2020 to 2024 (in £100 million)

Source: Gamma Data

In China, with the release of large-scale games such as Black Myth: Wukong, WuChang: Fallen Feathers, and the highly anticipated new work Phantom Blade Zero, the domestic market has become increasingly aware of the development potential of console games and the current demand gap. Many game developers no longer only focus on the mobile game market, but have turned their attention to the production of large-scale games.

The initial development trends of the two countries' game markets were different, but the current development paths are gradually converging.

Sam believes that Chinese game companies are very good at building player communities based on the games they develop, thereby operating the games for a longer period of time. British game companies, due to their accumulated rich experience in developing large-scale games, may have advantages in controlling game details. These two points are exactly what the two markets can learn from each other.

The following is the interview transcript, slightly edited for easier reading:

Learning from Each Other and Converging

Jinghe: Can you briefly share your feelings about ChinaJoy?

Sam: I am actually very interested in the development of ChinaJoy. I have been coming to China for many years, and I really like to understand this lively market by walking around. ChinaJoy is active and lively, and I think it's good to try to understand what's happening there. And CIGDC is held for the first time, and I think it's a very good initiative to gather game companies and studios from all over the world together.

When I first came to China ten years ago, I brought a British delegation and a Finnish delegation, and there were only these two countries here at that time. Although it may have given us a certain competitive advantage at that time, we are actually very happy to see companies from other countries, such as South Korea, Japan, and France, also come here. If we are serious about building connections in the game industry, then it's best to have many people participate.

Everyone here can bring something different, which is really good for us. And we also have the opportunity to get to know Japanese and Korean companies, which are opportunities we can't easily get usually. So CIGDC has done a great job in bringing people together.

Jinghe: The game development trends in each country may be different. The UK may be committed to developing 3A and other large-scale games, while in China, most companies are developing mobile games. Although many games are actually cross-platform, the main revenue still comes from mobile terminals. From your perspective, what do you think of these two different development trends? Are there any similarities or differences between China and the UK?

Sam: If a game company produces digital content that can be sold globally, it can be listed on digital stores and easily reach 150 or even 180 countries. This is not active sales; it's just displaying your game in digital stores, such as on mobile terminals, console terminals, or PC's Steam platform. But it's always better to personally go deep into the market, truly understand the subtle differences and key characteristics of different game markets, communicate with local enterprises, journalists, and media, and then figure out how to position your game by yourself.

That's why we travel around the world. As I said, launching a game is great, and you can generate income. But to be successful, you must understand different markets. And the Chinese market is very unique; it has two or three key factors that make it different from other parts of the world.

First of all, there are certain thresholds for releasing games in China. It is valuable and beneficial if you have a Chinese partner. Because a local company must be there to carry out the approval or submit the approval application.

The difficulty lies in obtaining the version number. The number of overseas games approved each year is limited, and I think the number of approved games is likely to reach around 2,000 by the end of this year. However, so far, China has only released about 100 non-domestic games, and this has been the case for three or four consecutive years.

However, the situation is changing. Games are becoming easier to release, and there is great demand. The growth rate of the Chinese game market has slowed down, and (perhaps) it is looking for content different from the games currently available in the market. The West has various games with good IPs, which have great potential to be bestsellers here and are popular among Chinese players, so now is an opportunity for us to bring games here.

Similarly, Chinese games are much better now than they were 5 or 10 years ago. We hope to encourage Chinese companies to cooperate with British publishers and media to release your games in the West as well. So there are actually two immediate opportunities here.

Thirdly, UK studios are highly investment-worthy. In the past 10 years, China has made 20 to 30 investments in UK game enterprises. China is expanding its influence and brand beyond the domestic market, and the government has also introduced measures to encourage enterprises to export and explore different markets, and we are happy to be partners in this regard. We are a very reliable, safe, and easy-to-cooperate market, and our games are also excellent.

Traditionally, the European market has been dominated by consoles and PCs. Now it's not like that anymore; mobile terminals have become the largest platform in Europe, and the same is true for the UK. We need to learn how to make better mobile games. Among our 20,000 game practitioners, 8,000 are engaged in mobile business, which is a pretty good proportion. But we still have a lot to learn in mobile terminals, and cooperating with Chinese companies is an excellent way to understand user engagement, monetization, and distribution. Well, we are excited about this.

Jinghe: The game development histories of China and the UK are quite different. The former is mainly based on mobile games, while the latter is mainly based on console games. In your opinion, what is the current status of mobile game development in the UK?

Sam: The previous view was that if you want to make a high-end game, i.e., a 3A game, due to equipment reasons, you would choose to make it on consoles and PCs, and it was difficult to make high-quality games on mobile terminals, which was the view in the UK. But I don't think this is true; mobile devices are much more powerful than ever before. And the standards of British mobile games are becoming better, higher, and more complex. It's just that it is still regarded as a device to be used when traveling or when you have five minutes of free time. So short-term game experiences, more interesting, colorful puzzle games are easier to implement on mobile terminals.

But the market is growing and developing, and there is indeed a momentum now prompting more Chinese players to play console and PC games. But many people have played games on mobile phones since childhood, so developers will prefer to make the best possible games on the most popular device—mobile devices. So it makes sense that we have chosen different paths, but I think we are actually converging with each other.

Jinghe: Is the slow development of the UK mobile game market due to the difficulty in changing user habits?

Sam: Historically, they have definitely been used to playing these games on game consoles, and sometimes it's hard to break a habit. It's just that compared to mobile terminals, consoles are expensive, and console games are also expensive. But after the release of Switch 2 a few months ago, it performed very well in Western markets such as the UK, so there is still demand for purchasing high-quality game consoles. I think this demand will continue with the new iterations and versions of Xbox and PlayStation, and those games will still be very popular, possibly more popular than their mobile versions.

However, the cost issue is also important. Chinese players grew up with mobile phones; they have used mobile phones since childhood, not only for communication but also for many payment scenarios. In China, everything in life can be done on mobile phones. But it's not necessarily the case in the UK; we have TVs for this, game consoles for that, and then mobile phones for other things. We are not so proficient in mobile devices and mobile literacy, which may affect the way we consume content.

Jinghe: What experience do you think UK studios have accumulated in 3A games that can be shared with Chinese 3A game developers?

Sam: I think an interesting point in the field of 3A games is that game companies want to reduce some risks and shorten the long production cycle. Some 3A games made in the UK take five or six years to produce. In specific products, the cost and risk are surprisingly high. And whether the return of these games is sufficient to justify all the investment is a question. A good large-scale game is becoming more and more "big", and large-scale games are also becoming more mainstream. They are no longer just a game; they can also be a book, a movie, a comic, or an exhibition, etc., with many expansion methods. We can see that more and more time is spent on game culture and the influence of game culture.

So there is still a lot of room for development in large-scale games, and we can help other companies and countries understand the larger game ecosystem, but we ourselves still need to continue learning. It would be great if we could complete these games with a smaller budget and faster speed. However, the game still needs to maintain quality, and we need to think about the most important thing: is this game the kind that can never be finished? Is it a 40-hour experience or a 6-hour experience? Is there a way to improve the production process to speed up while maintaining quality?

Game quality is still the most important thing for consumers. If a game is not as good as the previous version, they can tell at a glance. Players are very discerning consumers and will change their minds quickly. The most valuable 3A games are not those released only for one day. After their release, they can often survive for 10 years, which is the source of income and the source of the entire game community building.

In fact, Chinese companies are very good at building communities around games. I think we can learn from you, but perhaps you can also learn from us in some aspects of high quality and attention to details, which are crucial.

Games: A Valuable Creative Industry

Jinghe: If Chinese game companies want to enter the UK market, what suggestions would you give regarding distribution?

Sam: In fact, you can't just release games in the UK because it's a big market; you must focus on the entire European market and release games in this entire region.

Different regions have different languages, so completing localization is the minimum requirement. But I want to say that localization is difficult to do well. It's not just about language; the key lies in some subtle semantic differences. If you want to expand into markets outside your home country, localization is worthwhile, and the commercial returns are very considerable. It's really challenging; some things work in one country but not in another. For example, some words may be slang in another language, which would look a bit strange.

But I think if I were a Chinese enterprise focusing on the European market, I would first find a good publisher, a good public relations company, or a good marketing agency, which can review your content, help you think about European distribution matters, so that you can grasp the language and style, and then launch the game to the market.

Jinghe: What are the advantages of game distribution in the UK?

Sam: This is quite interesting. Each market offers slightly different things. But I am positive about the UK market, and I would recommend you to choose the UK as the base for your international business for several very good reasons.

Our regulations and legal system are extremely reliable and consistent. When you do business in the UK, you won't be surprised by anything because everything is exactly as we told you, and it won't change. So it's very stable and reliable, which means you can plan. Currently, setting up a studio or investing in the US is very difficult because the situation is constantly changing.

And our most precious asset is actually talent. British talents are probably the best in Europe, and I think they can compare with some top Chinese companies and some of the best talents on the US West Coast. Our advantage lies in the combination of creativity and technical ability. Many countries can produce games with beautiful graphics, but these games may not run properly, while we have perfectly combined the two.

However, the cost of talent in the UK is slightly higher. We are not the cheapest place to train talents or hire employees. But we have tax incentives in the UK, which makes us highly competitive in terms of pricing compared to other regions in Europe.

The current global game market is particularly challenging. You could invest in making a game that’s cheaper than a 3A title but of lower quality, and such a game won’t sell at all. Trying to make a game that’s merely "almost excellent" is almost pointless. You have to make a truly outstanding game to succeed, so you must go to the best places. I believe the UK ranks among the top ideal locations for game development. Other places are good too, but don’t settle for second-best. Invest a bit more, because you’ll get a better product, and that will make all the difference, my friend.

Jinghe: Compared to France and Germany, what do you think of the game development environment in the UK?

Sam: I think there are two things to discuss here. First, I’ve been in the game industry for a long time, around 25 years. When I first entered the industry, far fewer countries were making games. There were games made in the US, Canada, Europe, a bit in Australia, some in the Middle East, and many in China. So, what’s happened today? People have realized that games are fantastic, popular, and that game companies can make money. Now almost every country makes games, which wasn’t the case 25 years ago. As a result, more and more games are being made globally. Some might say there are too many games now, but that’s not surprising. Gaming is a growing industry; it’s a sector on the rise, and the Chinese game market has seen double-digit annual growth rates.

Given that, why not participate in game development? So I’m not surprised by this trend. I actually hope fewer games are made, so that the ones produced can be more successful. I also wish the UK could take a more dominant position in the market, but our market share remains unchanged for now.

Interestingly, even though other countries make different types of games, if you ask players to name the most famous games, they might pick one or two from France or Germany, but they’ll list seven or eight British games. I think it’s good for games to come from different places, because ultimately, we want players to enjoy playing them. And players are all different, so offering them diverse games is a good thing. But when I show a list of the best UK-made games on screen, I think most people will recognize them. You don’t always see that with games from other countries.

Jinghe: Has the UK government’s policy had any positive impact on game companies or the industry as a whole?

Sam: I think if we look back about 10 years, the government wasn’t particularly interested in games. They didn’t really understand what games were, seeing them as a bit of a fad, a trend, something young people did. But they understood film, TV, music, and fashion. These industries have promoted themselves well globally and built IPs around themselves, and they’re all creative industries just like games. I think it took some time for the game industry to convince the government that we are, in fact, a valuable creative industry.

To some extent, it was the data that changed the government’s mind. The game industry generates more revenue for the UK than the film and music industries combined. The government is now starting to recognize the value and contribution of games compared to other creative industries they already endorse. But if you stopped a member of parliament on the street today and asked them to name some games, their answer would include very few. So I still think there’s a communication gap, an educational step, to ensure the government understands the value of games. However, the government has started investing in games, and the industry has thrived even without government support. So imagine how well we could do with government backing.

If government funding goes to small studios, they can use it to build their own IPs. Once they have enough funds to create a game demo, they can take it to publishers and investors. That’s where the government is trying to make a difference. Another huge benefit the government brings is institutional investment, including from cities, financial institutions, angel investors, and VCs. If they see the government supporting the industry, they’ll follow suit. So private funds come after government funds, and that will have a huge impact.

Jinghe: Previously, Ukie called on the UK government to specifically support small and medium-sized independent game companies. Could you elaborate on this issue and how such policies would affect small and medium-sized developer teams?

Sam: Sure. It used to be called Video Games Tax Relief (VGTR), which was approved a few years ago when the UK was still in the EU. Getting approval for VGTR was difficult, and not all European countries had the same policy.

Now that we’re out of Europe, our government has the ability to change tax rates for video games, or as you might call it, adjust video game expenditure credits. They no longer have to follow EU rules and can take any measures to stimulate the industry. The Video Games Expenditure Credit allows companies to apply for reimbursement of related costs.

The calculation of this cost is a bit complex: it’s 25% of 80% of your costs, which effectively works out to about 20% of your costs. This includes salaries, design costs, and everything needed to make a game. You can apply to the UK government to reclaim 20% of these costs. It’s an incredible benefit, absolutely fantastic, and many companies take advantage of it. If you’re an international developer with 500 employees in the UK, 20% of your costs are covered by the government. That’s a big deal. Obviously, it helps both large and small companies. For small companies, it gives them the necessary power to launch and promote their games in the market, so it’s supporting companies of all sizes.

This is what Ukie wants to improve. Many countries around the world now have tax relief policies. The UK used to have a very good one, but now it’s only at a medium level compared to others, though it’s still good. When we first introduced this concept, the UK’s salary levels and cost of living were slightly higher than in other parts of Eastern Europe. Living costs are higher and expenses are greater in the UK, but tax relief means we’re on par with other countries.

So now we must ensure we remain competitive in core costs, but you get better games from the UK. If you can make a game in the UK at the same cost, you should do it there, because the end product will be better.

We also have a less well-known R&D tax relief. So if you’re developing a game in a way that requires certain functions not available in current software, you have to modify the software, recode it, and conduct R&D to achieve those functions. You can apply for tax relief on those costs too. It’s quite an interesting form of tax support.

We also have investment tax relief, like the angel investors I mentioned. The game industry has been around for 40 years now, and some people who’ve worked in it their whole lives are retiring. This is the first time we’re seeing people retire from the game industry, and they’ve likely accumulated some wealth. In the UK, under various tax relief schemes, individuals are allowed to invest in game companies and tech companies and get tax relief on their personal costs. So instead of paying taxes to the government, you can invest, and some of those investments are likely to bring you good returns. We’re getting angel investments, and as people retire now, their expertise is flowing back into the industry.

Jinghe: So the tax relief is actually targeted at developers, not publishers?

Sam: Under the same scheme, publishers aren’t eligible for investment. If you’re part of the creative industry, you have to be an innovative creative or tech enterprise to qualify.

But honestly, the line between publishers and developers is very blurred these days. A developer will make a game and put it on digital stores. Does that make them a publisher? They’re actually both publishers and developers. Think about all the biggest publishers in the UK: EA, Activision, Blizzard, Sega—they’re both developers and publishers. The difference is just a word.

Game Globalization, Supported by Ukie

Jinghe: Over the next three to five years, in what areas do you think Ukie can support UK game companies entering China or assist Chinese game companies in setting up subsidiaries in the UK?

Sam: Ukie is a broader organization than you might imagine, and we mainly do two things. We work to create the right environment for games to succeed. That includes government lobbying, age rating, diversity initiatives, sustainability, and educational programs. We do all these things to foster an environment where games can thrive. Without these relationships with the government and institutions, games might not succeed.

The second thing Ukie does is provide personalized business support to companies. So publishers can come to us, and we’ll connect them with numerous developers worldwide. Developers come to us, and we’ll introduce them to investors or publishers, take them to China, to GDC. We have a lot of market data, host many networking events, and create numerous opportunities. You don’t have to be a British company to be a member of Ukie. Tencent is a member, NetEase is a member, and about 10 to 12 Chinese companies are part of Ukie.

But if you’re a successful game company, or want to be one, three things you really need right now are funding—obviously crucial for growth. Then there’s talent acquisition: how to attract talent to your company.

Third is access to international markets, creating opportunities globally. We’re sitting in Shanghai right now. Last week, Ukie attended a small summit in Osaka, Japan. In two weeks, we’ll be going to Gamescom in Cologne, Germany. So we’re traveling the world with game companies, creating opportunities for them. Our job is to focus on individual companies, provide the support they need, while also looking at the bigger picture to see how we can change the entire market for everyone’s benefit. I’m here to help anyone.

I think every member adds value to our network. Everyone has value, and everyone matters.

Jinghe: I heard there are different types of memberships?

Sam: No, there’s only one type of membership. But your fees depend on your ability to pay. Our minimum annual fee is £630, and the maximum is £88,000. Larger companies with higher turnover pay more. For business in China, if they don’t have offices or operations with Ukie, we probably won’t charge very high fees.

But regardless of how much you pay, everyone enjoys the same benefits. We often find that larger companies have more staff, meaning different people can work with us on various areas like government relations, education, trade, publishing, and investment, leading to deeper collaboration. A startup with only three employees usually focuses on one or two things. It’s a very fair system. Everyone gets access to the same resources.

Jinghe: What support does Ukie provide to companies looking to expand their business in the UK?

Sam: We can help non-British companies set up offices in the UK. We can introduce lawyers, assist with company registration, connect you with banks, insurance companies, and tax firms. We also refer all the businesses you need to operate, and link your company with the UK game industry so you can connect with companies you want to collaborate with.

If you need it, we can also introduce you to media, government officials, and local public servants. So all these different activities are open to developers, publishers, and funders. That’s our entire network. It’s a large and mostly friendly network—we bring in talent and integrate them into it.

本文系作者Gong Shiya授权竞核发表,并经竞核编辑,转载请注明出处、作者和本文链接。想和千万竞核用户分享你的新奇观点和发现,点击这里投稿。